The Advantages of Decentralized Finance in Crypto, this introduction will take you on a wild ride through the world of DeFi, where financial rules are rewritten and opportunities are limitless.

Let’s dive into the realm of decentralized finance and explore the groundbreaking benefits it offers in the crypto space.

Introduction to Decentralized Finance (DeFi)

Decentralized Finance, commonly referred to as DeFi, is a revolutionary concept within the cryptocurrency space that aims to provide financial services without the need for traditional intermediaries like banks or financial institutions. Instead, DeFi leverages blockchain technology to create a decentralized ecosystem where users can access various financial services directly.

Key Principles of DeFi

- Transparency: All transactions and operations within DeFi are recorded on the blockchain, ensuring complete transparency for all participants.

- Accessibility: DeFi services are accessible to anyone with an internet connection, allowing for financial inclusion on a global scale.

- Security: The use of smart contracts on the blockchain ensures that transactions are secure and irreversible once executed.

- Interoperability: DeFi protocols are designed to be interoperable, allowing different platforms to work together seamlessly.

Differences from Traditional Financial Systems

- Centralization: Traditional financial systems rely on centralized institutions to facilitate transactions and manage funds, while DeFi operates in a decentralized manner.

- Permissionless: DeFi platforms are permissionless, meaning anyone can participate without needing approval from a central authority.

- Censorship Resistance: Since DeFi is decentralized, it is resistant to censorship and external control, unlike traditional financial systems that can be subject to government intervention.

- Global Access: DeFi allows users from anywhere in the world to access financial services without the need for a physical presence or local banking infrastructure.

Enhanced Financial Inclusion

Decentralized Finance (DeFi) plays a crucial role in enhancing financial inclusion by providing opportunities for individuals who are unbanked or underbanked to access financial services that were previously out of reach.

Global Access to Financial Services

DeFi projects have the potential to revolutionize the way financial services are accessed globally. By leveraging blockchain technology, DeFi platforms offer a borderless financial ecosystem that allows anyone with an internet connection to participate in various financial activities.

- Through DeFi lending protocols, individuals in underserved regions can borrow funds without the need for traditional bank accounts or credit history.

- Smart contracts in DeFi enable peer-to-peer transactions, eliminating the need for intermediaries and reducing transaction costs, making financial services more affordable and accessible.

- Platforms like Compound and Aave provide users with opportunities to earn interest on their crypto assets, creating avenues for wealth accumulation for those excluded from traditional banking systems.

Transparency and Security

In decentralized finance (DeFi), transparency and security play crucial roles in ensuring the integrity of transactions and protecting user assets.

Advantages of Transparency in DeFi Transactions

- All transactions on the blockchain are publicly recorded and can be viewed by anyone, ensuring accountability and reducing the risk of fraud.

- Users can verify the authenticity of transactions and track the flow of funds, promoting trust in the system.

- Decentralized platforms often provide open access to their smart contracts, allowing users to review the code for potential vulnerabilities.

Enhanced Security with Blockchain Technology

- Blockchain technology utilizes cryptographic algorithms to secure transactions, making it extremely difficult for unauthorized parties to tamper with or alter data.

- The decentralized nature of blockchain networks reduces the risk of a single point of failure, enhancing the security of financial transactions.

- Immutable ledgers on the blockchain ensure that once a transaction is recorded, it cannot be altered or deleted, providing a high level of security.

Role of Smart Contracts in Security and Transparency, The Advantages of Decentralized Finance in Crypto

- Smart contracts are self-executing contracts with the terms of the agreement directly written into code, ensuring automatic execution of transactions without the need for intermediaries.

- By eliminating the need for intermediaries, smart contracts reduce the risk of human error and potential manipulation, enhancing security in DeFi transactions.

- Smart contracts also increase transparency by providing a clear set of rules that all parties must adhere to, reducing the likelihood of disputes or misunderstandings.

Lower Costs and Fees: The Advantages Of Decentralized Finance In Crypto

In the realm of decentralized finance (DeFi), one of the most significant advantages is the lower costs and fees associated with transactions compared to traditional financial systems.

Elimination of Intermediaries

In traditional finance, transactions often involve multiple intermediaries such as banks, payment processors, and clearinghouses. Each intermediary adds a layer of cost, resulting in higher fees for users. DeFi platforms, on the other hand, operate on blockchain technology, which allows for peer-to-peer transactions without the need for intermediaries. This direct interaction between users eliminates the additional costs associated with intermediaries, leading to lower fees for transactions.

Reduced Transaction Costs

DeFi platforms leverage smart contracts to automate and execute transactions without the need for manual intervention. This automation reduces operational costs and streamlines the transaction process, ultimately lowering transaction fees for users. Additionally, DeFi platforms are often decentralized, meaning that there is no central authority imposing fees or charges. Users have more control over their funds and can avoid the high fees typically charged by centralized financial institutions.

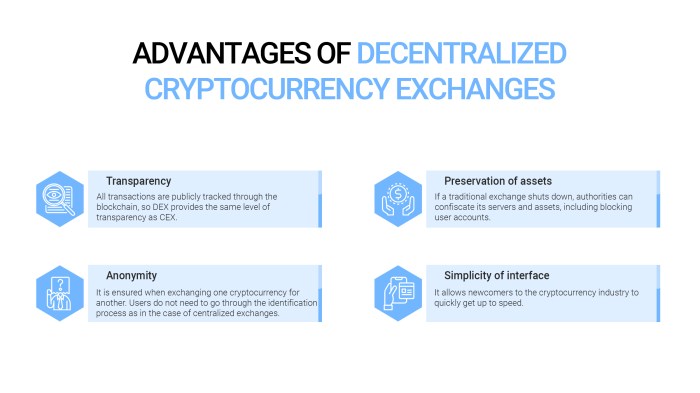

Example: Decentralized Exchanges

Decentralized exchanges (DEXs) are a popular DeFi application that allows users to trade cryptocurrencies directly with one another. By cutting out the middlemen typically found in centralized exchanges, DEXs significantly reduce trading fees. For example, users on a DEX like Uniswap can swap tokens at a fraction of the cost compared to traditional exchanges. The absence of intermediaries and the automated nature of transactions on DEXs contribute to the overall lower costs and fees associated with DeFi transactions.

Programmability and Innovation

Decentralized Finance (DeFi) platforms are revolutionizing the financial industry by allowing for programmable automated transactions. Through the use of smart contracts, DeFi protocols enable users to execute transactions without the need for intermediaries, reducing costs and increasing efficiency.

Flexibility and Innovation with DeFi Smart Contracts

Smart contracts within DeFi platforms offer unparalleled flexibility and innovation in the financial sector. These self-executing contracts automatically enforce and facilitate the terms of an agreement, eliminating the need for manual intervention. This automation not only streamlines processes but also opens up a world of possibilities for creating new financial products and services.

- One example of innovative DeFi projects is Uniswap, a decentralized exchange that allows users to trade cryptocurrencies directly from their wallets without the need for a centralized authority. Uniswap’s automated market-making mechanism provides liquidity to traders and enables seamless token swaps.

- Another groundbreaking DeFi project is Aave, a decentralized lending platform that allows users to borrow and lend cryptocurrencies without intermediaries. Aave’s innovative flash loan feature enables users to borrow funds without collateral, revolutionizing the lending market.

- Compound Finance is yet another pioneering DeFi platform that offers algorithmic money markets for users to earn interest on their cryptocurrency holdings or borrow assets. The platform’s smart contracts automatically adjust interest rates based on supply and demand, providing a dynamic and efficient financial ecosystem.