Understanding the Crypto Halving Process sets the stage for unraveling the secrets behind this crucial event in the world of cryptocurrency. Brace yourself for a journey through the intricate workings of Bitcoin’s halving phenomenon.

Overview of Crypto Halving Process

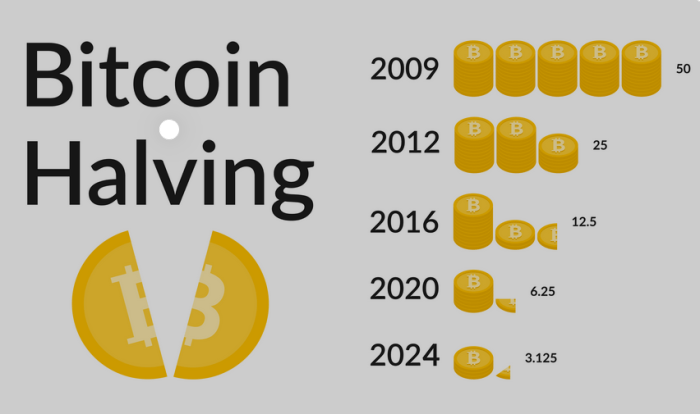

The crypto halving process is a fundamental event in the world of cryptocurrencies where the rewards miners receive for validating transactions are reduced by half. This process occurs at pre-defined intervals and has a direct impact on the supply and issuance of the cryptocurrency.

The purpose of the halving process is to control inflation and ensure that the total supply of the cryptocurrency remains limited. By reducing the rewards given to miners, the halving process slows down the rate at which new coins are introduced into circulation, thereby increasing scarcity and potentially driving up the value of the cryptocurrency.

Halving events are significant for cryptocurrencies as they often lead to increased attention from investors and traders. The anticipation of reduced supply combined with the historical impact on price performance makes halving events a focal point for market analysis and speculation.

Historical Context of Crypto Halving: Understanding The Crypto Halving Process

The crypto halving process has a rich history that dates back to the creation of Bitcoin. Let’s explore how this event has evolved over time and its impact on the cryptocurrency space.

The First Crypto Halving Event

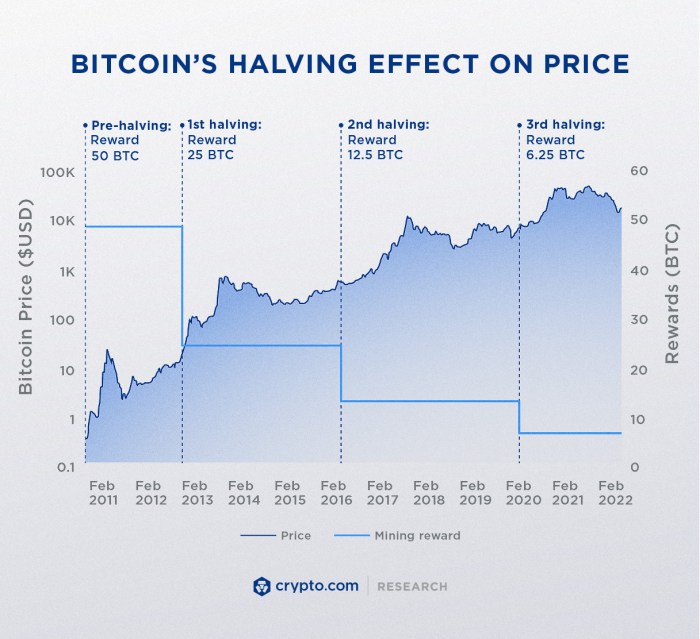

The first-ever crypto halving event took place on November 28, 2012, when the block reward for miners was reduced from 50 BTC to 25 BTC. This event marked a significant milestone in the history of Bitcoin and set the stage for future halving events.

Evolution of Halving Events, Understanding the Crypto Halving Process

Since the first halving event, Bitcoin has gone through several more halvings, with the most recent one occurring in May 2020. The halving process has become a well-known and anticipated event in the cryptocurrency community, with each halving leading to a reduction in the rate at which new coins are created.

Impact of Past Halving Events

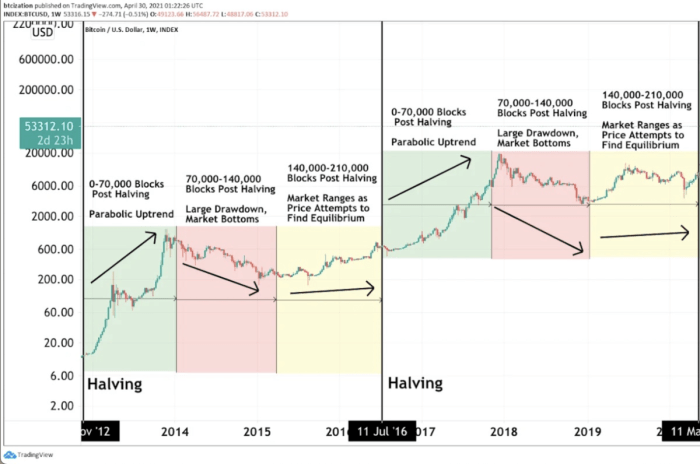

Past halving events have had a profound impact on the value of cryptocurrencies. In the months leading up to a halving event, there is often a surge in demand as investors anticipate a decrease in the supply of new coins. This increased demand can lead to price appreciation and heightened market volatility. Following the event, the supply shock caused by the halving typically leads to a period of price consolidation and, in many cases, a subsequent bull run in the cryptocurrency markets.

Mechanism of Crypto Halving

In the world of cryptocurrency, the halving process is a crucial event that impacts the entire ecosystem. Let’s dive into how this mechanism works and its implications.

The Halving Process

The halving process in cryptocurrency refers to the event where the rewards for mining new blocks are cut in half. This occurs at pre-programmed intervals and is a key component of the blockchain technology.

- Every time a certain number of blocks are mined, typically around every four years, the rewards for miners are halved.

- This reduction in mining rewards is a way to control the inflation of the cryptocurrency and ensure a limited supply of coins.

- As a result, the halving mechanism helps maintain the scarcity and value of the cryptocurrency over time.

Algorithm and Protocol

The specific algorithm and protocol behind the halving mechanism vary depending on the cryptocurrency. However, the concept remains the same – to gradually reduce the supply of new coins entering circulation.

For example, in the case of Bitcoin, the protocol dictates that the block rewards are halved approximately every four years, with a total cap of 21 million coins that can ever be mined.

Implications on Mining Rewards and Coin Supply

The halving has significant implications on both mining rewards and the overall coin supply of a cryptocurrency.

- Miners experience a direct impact on their profits as the rewards for mining are reduced by half. This can lead to a decrease in mining activity or a shift in mining power to more profitable cryptocurrencies.

- On the other hand, the reduction in the rate of new coin issuance helps maintain the scarcity of the cryptocurrency, potentially driving up its value in the long run.

- Overall, the halving mechanism plays a crucial role in ensuring the sustainability and value of a cryptocurrency by carefully controlling its supply and demand dynamics.

Effects of Halving on Cryptocurrency Market

When it comes to the cryptocurrency market, the halving events have a significant impact on various aspects, especially price volatility and miners’ rewards. Let’s dive into how these events influence the market in both the short and long term.

Price Volatility

One of the immediate effects of a halving event is increased price volatility in the cryptocurrency market. This is primarily due to the sudden reduction in the rate at which new coins are created, leading to a potential imbalance between supply and demand.

- As the supply of new coins decreases, the existing supply becomes scarcer, which can drive up prices as demand remains constant or increases.

- However, this price surge can also attract more traders looking to capitalize on the momentum, leading to increased trading volumes and heightened volatility.

- Overall, the price fluctuations following a halving event can be both rapid and substantial, creating opportunities for significant gains or losses for investors.

Miners’ Rewards

Halving events also have a direct impact on miners’ rewards, affecting their profitability and incentivizing changes in mining behavior.

- With the reduction in block rewards following a halving, miners receive fewer coins for validating transactions, which can decrease their overall earnings.

- This can lead to smaller mining operations becoming unprofitable and shutting down, while larger players with better resources may continue to operate despite lower rewards.

- As a result, the distribution of mining power may shift, potentially centralizing control in the hands of a few major mining pools, impacting the decentralization of the network.

Long-Term Effects

Looking beyond the immediate impact, halving events can have lasting effects on the cryptocurrency market and ecosystem.

- One long-term effect is the increased scarcity of coins due to the reduced rate of new supply entering the market, which can drive up prices over time as demand continues to grow.

- Additionally, the halving events serve as a reminder of the deflationary nature of most cryptocurrencies, highlighting their potential as a store of value similar to precious metals like gold.

- Moreover, the predictability of halving events every few years can influence investor behavior, creating cycles of anticipation and speculation that impact market dynamics.

Investor Strategies during Halving

Investors often adopt different strategies during halving events to maximize their gains and minimize risks. This period can be volatile, so having a clear plan is crucial for success.

Risk Management Techniques for Traders during Halving Periods

During halving periods, traders can employ various risk management techniques to protect their investments. Some common strategies include:

- Diversifying their portfolio to reduce exposure to any single asset

- Setting stop-loss orders to limit potential losses

- Staying informed about market trends and news to make informed decisions

- Avoiding emotional trading and sticking to a predetermined plan

Examples of Successful Investment Approaches during Halving Cycles

Successful investors during halving cycles often follow these approaches:

- Buying and holding long-term to benefit from potential price increases post-halving

- Engaging in dollar-cost averaging to mitigate the impact of market fluctuations

- Participating in staking or lending programs to earn passive income during the halving period

- Taking profits strategically to lock in gains and reduce exposure to market risks

Future Outlook of Crypto Halving

As we look ahead to the future of cryptocurrency after halving events, it is essential to consider the potential trends that may emerge in the crypto market. Halving events play a crucial role in shaping the future of cryptocurrencies, influencing everything from market dynamics to investor sentiment. Let’s explore how halving impacts the overall adoption and acceptance of digital currencies.

Potential Trends in the Crypto Market Post-Halving

Following a halving event, we can expect to see increased scarcity of the cryptocurrency due to reduced block rewards. This scarcity often leads to an increase in demand, driving up the price of the digital asset. Additionally, the reduced supply of new coins entering the market can result in greater price volatility as investors adjust to the new supply dynamics.

Role of Halving Events in Shaping the Future of Cryptocurrencies

Halving events serve as a mechanism to control inflation and ensure the sustainability of a cryptocurrency. By reducing the rate at which new coins are created, halving events help maintain the scarcity of the digital asset over time. This can lead to increased value for investors and a more stable ecosystem for the cryptocurrency.

Impact of Halving on Adoption and Acceptance of Digital Currencies

Halving events can also impact the adoption and acceptance of digital currencies in the broader market. As the price of a cryptocurrency increases following a halving event, it may attract more mainstream attention and interest from both individual and institutional investors. This increased adoption can help solidify the position of the cryptocurrency in the global financial landscape.