How to Diversify Your Crypto Portfolio dives into the world of cryptocurrency investments, offering insights on the importance of diversification and practical strategies to minimize risks and maximize returns.

Importance of Diversifying Your Crypto Portfolio

Diversifying your crypto portfolio is crucial in the volatile cryptocurrency market to spread out risks and maximize potential returns. By investing in a variety of cryptocurrencies, you can reduce the impact of a single asset’s performance on your overall portfolio.

How Diversification Mitigates Risks

- Diversification helps to minimize the impact of a significant loss in one cryptocurrency by spreading your investments across multiple assets.

- It can protect your portfolio from sudden market fluctuations or crashes that may affect specific coins or tokens.

- By diversifying, you can potentially increase your chances of capitalizing on the growth of different cryptocurrencies in the market.

Consequences of Not Diversifying Your Portfolio

- If you put all your funds into one cryptocurrency and it experiences a significant decline, you could face substantial losses.

- Without diversification, you are more vulnerable to market volatility and the risk of losing a large portion of your investment in a short period.

- Missing out on potential gains from other promising cryptocurrencies can limit your overall returns and growth opportunities.

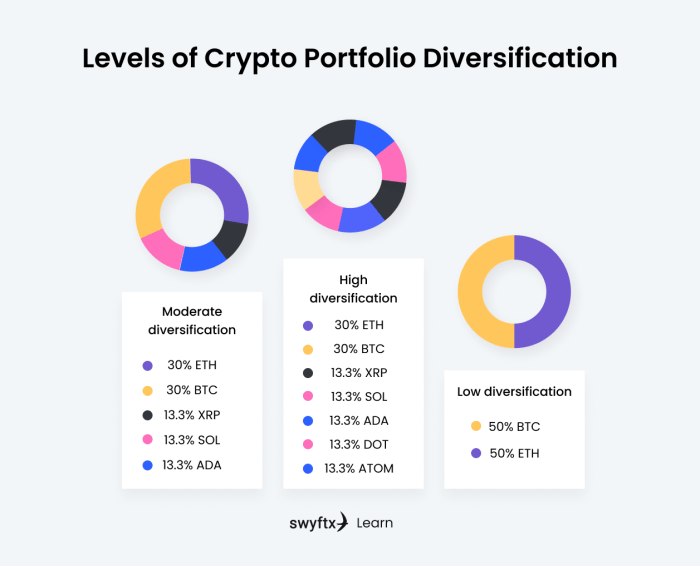

Strategies for Diversifying Your Crypto Portfolio: How To Diversify Your Crypto Portfolio

Diversifying your crypto portfolio is crucial to mitigate risks and maximize potential returns. By including different types of cryptocurrencies in your portfolio, you can spread your investments across various assets and increase the chances of achieving profitable outcomes.

Identify Different Types of Cryptocurrencies

- Bitcoin (BTC): The first and most well-known cryptocurrency, often considered a store of value.

- Ethereum (ETH): A platform for decentralized applications and smart contracts.

- Ripple (XRP): Primarily used for facilitating cross-border payments.

- Litecoin (LTC): Known for faster transaction speeds compared to Bitcoin.

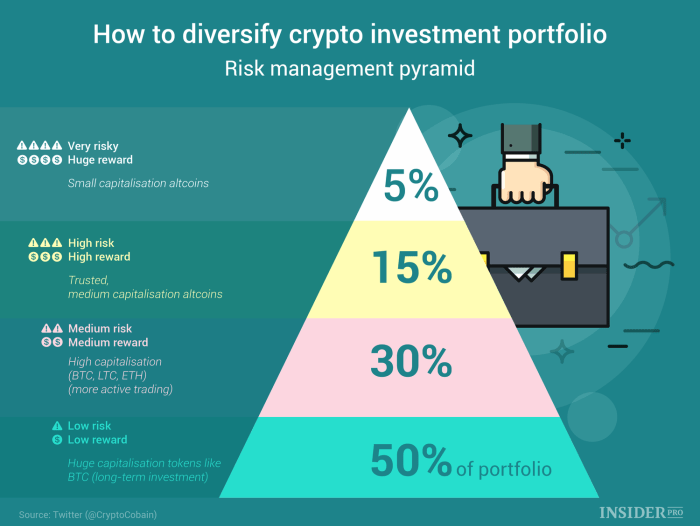

Spreading Investments Across Various Crypto Assets, How to Diversify Your Crypto Portfolio

- Allocate your investments across different cryptocurrencies to reduce the impact of price fluctuations in any single asset.

- Consider diversifying across different sectors, such as privacy coins, platforms, and payment tokens.

- Regularly rebalance your portfolio to maintain the desired allocation and adapt to market conditions.

Benefits of Mixing Different Types of Cryptocurrencies

- Minimize the risk of total loss by not putting all your eggs in one basket.

- Potential for higher returns as different cryptocurrencies may perform differently in various market conditions.

- Enhance liquidity and flexibility in your portfolio by having exposure to a variety of assets.

Research and Analysis for Diversification

When it comes to diversifying your crypto portfolio, conducting thorough research and analysis is crucial to make informed decisions and maximize your investment potential. By staying informed about market trends and performance, you can identify promising cryptocurrencies to add to your portfolio.

Researching Potential Cryptocurrencies

- Start by researching the background of the cryptocurrency, including its whitepaper, team members, and overall mission.

- Look into the technology behind the cryptocurrency and assess its scalability, security, and potential for real-world adoption.

- Consider the market demand for the cryptocurrency and how it differentiates itself from competitors.

Market Trends and Performance Analysis

- Monitor the price movements and trading volume of different cryptocurrencies to identify trends and patterns.

- Use technical analysis tools to assess the historical performance of a cryptocurrency and predict future price movements.

- Stay updated on news and developments in the crypto space that could impact the performance of specific cryptocurrencies.

Staying Informed

- Follow reputable crypto news websites, forums, and social media channels to stay informed about the latest developments in the industry.

- Join online communities and engage with other crypto enthusiasts to gain insights and perspectives on potential investment opportunities.

- Attend crypto conferences, webinars, and events to network with industry experts and expand your knowledge about the market.

Risks and Challenges of Diversification

Diversifying your crypto portfolio comes with its own set of risks and challenges that investors need to be aware of to make informed decisions.

Market Volatility

One of the common risks associated with diversifying a crypto portfolio is market volatility. The prices of cryptocurrencies can fluctuate wildly in a short period of time, leading to potential losses across different assets.

Liquidity Issues

Investors may face challenges with liquidity when diversifying their crypto holdings. Some smaller or less popular cryptocurrencies may have lower liquidity, making it difficult to buy or sell large quantities without significantly impacting the market price.

Security Concerns

Another challenge is security concerns. Managing a diversified portfolio means dealing with multiple wallets and exchanges, increasing the risk of security breaches and hacks. It’s crucial to prioritize security measures to protect your assets.

Overlapping Investments

Investors may also unintentionally overlap investments when diversifying their crypto portfolio. This can reduce the benefits of diversification and increase the correlation between assets, leading to higher risks in the overall portfolio.

Strategies to Overcome Risks and Challenges

- Diversify Across Different Asset Classes: Consider diversifying not only within cryptocurrencies but also across other asset classes like stocks, bonds, or real estate to reduce overall risk.

- Regularly Rebalance Your Portfolio: Keep track of your investments and adjust your portfolio regularly to maintain the desired asset allocation and minimize risks.

- Stay Informed and Conduct Research: Stay updated on market trends and conduct thorough research before making investment decisions to mitigate risks and make informed choices.