Kicking off with Understanding the Risks of DeFi Investments, this opening paragraph is designed to captivate and engage the readers, setting the tone american high school hip style that unfolds with each word.

DeFi, short for decentralized finance, is the wild west of the financial world, where risks and rewards collide in the digital realm. As investors dive into this new frontier, they must navigate through a jungle of uncertainties and potential pitfalls. Let’s explore the dangers lurking in the shadows of DeFi investments and how to stay ahead of the game.

What is DeFi?

Decentralized Finance (DeFi) refers to a system in which financial products and services are built on blockchain technology, allowing users to engage in various financial activities without the need for traditional intermediaries like banks. DeFi aims to provide a more inclusive, transparent, and efficient financial ecosystem for users worldwide.

Key Characteristics of DeFi

- Decentralization: DeFi platforms operate without a central authority, giving users more control over their assets.

- Transparency: All transactions on the blockchain are visible to the public, ensuring trust and accountability.

- Interoperability: DeFi protocols can interact with each other, creating a seamless experience for users.

- Smart Contracts: Automated contracts execute transactions when specific conditions are met, eliminating the need for intermediaries.

Difference from Traditional Finance

- Accessibility: DeFi is accessible to anyone with an internet connection, unlike traditional finance that may have barriers to entry.

- Censorship Resistance: DeFi platforms are resistant to censorship, allowing users to participate freely without restrictions.

- Global Reach: DeFi operates on a global scale, enabling cross-border transactions without the need for currency conversions.

Popular DeFi Platforms and Functions, Understanding the Risks of DeFi Investments

- Uniswap: A decentralized exchange (DEX) where users can swap various tokens without the need for an intermediary.

- Compound: A lending protocol that allows users to earn interest by supplying assets or borrowing them from the platform.

- Aave: A decentralized lending platform that enables users to borrow and lend assets without centralized control.

Risks Associated with DeFi Investments

Investing in Decentralized Finance (DeFi) comes with various risks that investors should be aware of before diving into this fast-growing sector. Understanding these risks is crucial to making informed investment decisions in the volatile world of cryptocurrency.

Volatility of Cryptocurrency Prices

Cryptocurrencies are known for their price volatility, which can have a significant impact on DeFi investments. Prices of digital assets can fluctuate rapidly within short periods, leading to potential gains or losses for investors. This volatility adds a layer of uncertainty to DeFi investments, making it important for investors to carefully monitor the market and be prepared for sudden price changes.

Potential Security Vulnerabilities in DeFi Platforms

While DeFi platforms offer innovative solutions for financial services, they are also vulnerable to security risks. Smart contracts, which are fundamental to many DeFi protocols, can be susceptible to bugs and vulnerabilities that could be exploited by malicious actors. Hacks and security breaches have occurred in the DeFi space, resulting in significant financial losses for investors. It is essential for investors to conduct thorough research on DeFi platforms, assess their security measures, and consider the risks involved before investing their funds.

Smart Contract Risks

Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller directly written into lines of code. They run on the blockchain, allowing for secure and automated transactions without the need for intermediaries.

Potential Risks

- Code Vulnerabilities: Smart contracts are only as secure as the code written. Even small errors can lead to significant losses if exploited by malicious actors.

- Immutable Nature: Once deployed on the blockchain, smart contracts cannot be altered. If a vulnerability is discovered after deployment, it can be challenging to rectify the issue.

- Dependency on Oracles: Smart contracts often rely on external data sources known as oracles. If these oracles provide inaccurate data, it can lead to incorrect outcomes and financial losses.

Examples of Past Incidents

The DAO Hack: In 2016, a vulnerability in a smart contract called The DAO led to the theft of over $50 million worth of Ether. This incident highlighted the risks associated with code vulnerabilities in smart contracts.

Bancor Network Hack: In 2018, the Bancor Network suffered a security breach that resulted in the loss of $23.5 million. The hackers exploited a vulnerability in a smart contract to withdraw funds from the platform.

Regulatory and Compliance Risks: Understanding The Risks Of DeFi Investments

As the DeFi space continues to grow rapidly, regulatory and compliance risks have become significant concerns for platforms and investors alike. The decentralized nature of DeFi poses unique challenges when it comes to adhering to traditional regulatory frameworks.

Regulatory Challenges Faced by DeFi Platforms

DeFi platforms often struggle to navigate the complex and ever-changing regulatory landscape. Without a central authority overseeing operations, it can be challenging to ensure compliance with regulations that vary from country to country. This lack of regulatory clarity can lead to legal uncertainties and potential risks for both platforms and users.

Potential Impact of Changing Regulations on DeFi Investments

- Changes in regulations can have a profound impact on DeFi investments, affecting everything from user privacy to the overall security of the platform.

- Increased regulatory scrutiny may result in additional compliance requirements, which could deter investors and limit the growth of DeFi projects.

- Conversely, clear and favorable regulations could provide a boost to the DeFi ecosystem, attracting more institutional investors and fostering innovation in the space.

Importance of Compliance Measures in the DeFi Space

Compliance measures play a crucial role in ensuring the legitimacy and sustainability of DeFi projects. By implementing robust compliance protocols, platforms can enhance trust among users and mitigate the risks associated with regulatory uncertainties.

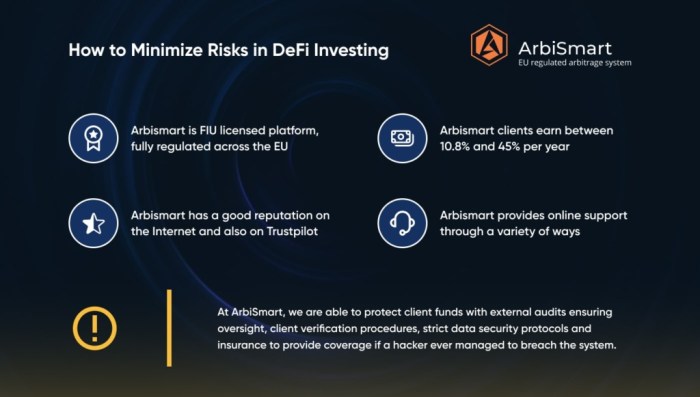

Mitigation Strategies

Investing in DeFi projects can be lucrative, but it also comes with its own set of risks. To mitigate these risks, it is crucial to employ certain strategies that can help protect your investments and minimize potential losses. Conducting thorough due diligence before investing and diversifying your portfolio are key steps in managing risks associated with DeFi investments.

Importance of Due Diligence

Before investing in any DeFi project, it is essential to conduct thorough due diligence. This involves researching the project team, evaluating the project’s whitepaper, reviewing the smart contract code, and assessing the project’s roadmap and goals. By carefully examining these aspects, investors can gain a better understanding of the project’s legitimacy and potential risks.

Diversification of Portfolio

Diversifying your DeFi investment portfolio is another effective strategy to mitigate risks. Instead of putting all your funds into a single project, spread your investments across multiple projects. This helps reduce the impact of any potential losses from one project on your overall portfolio. By diversifying, investors can hedge against the risk of a single project failing or experiencing significant setbacks.